Exploring the Aave DeFi Ecosystem

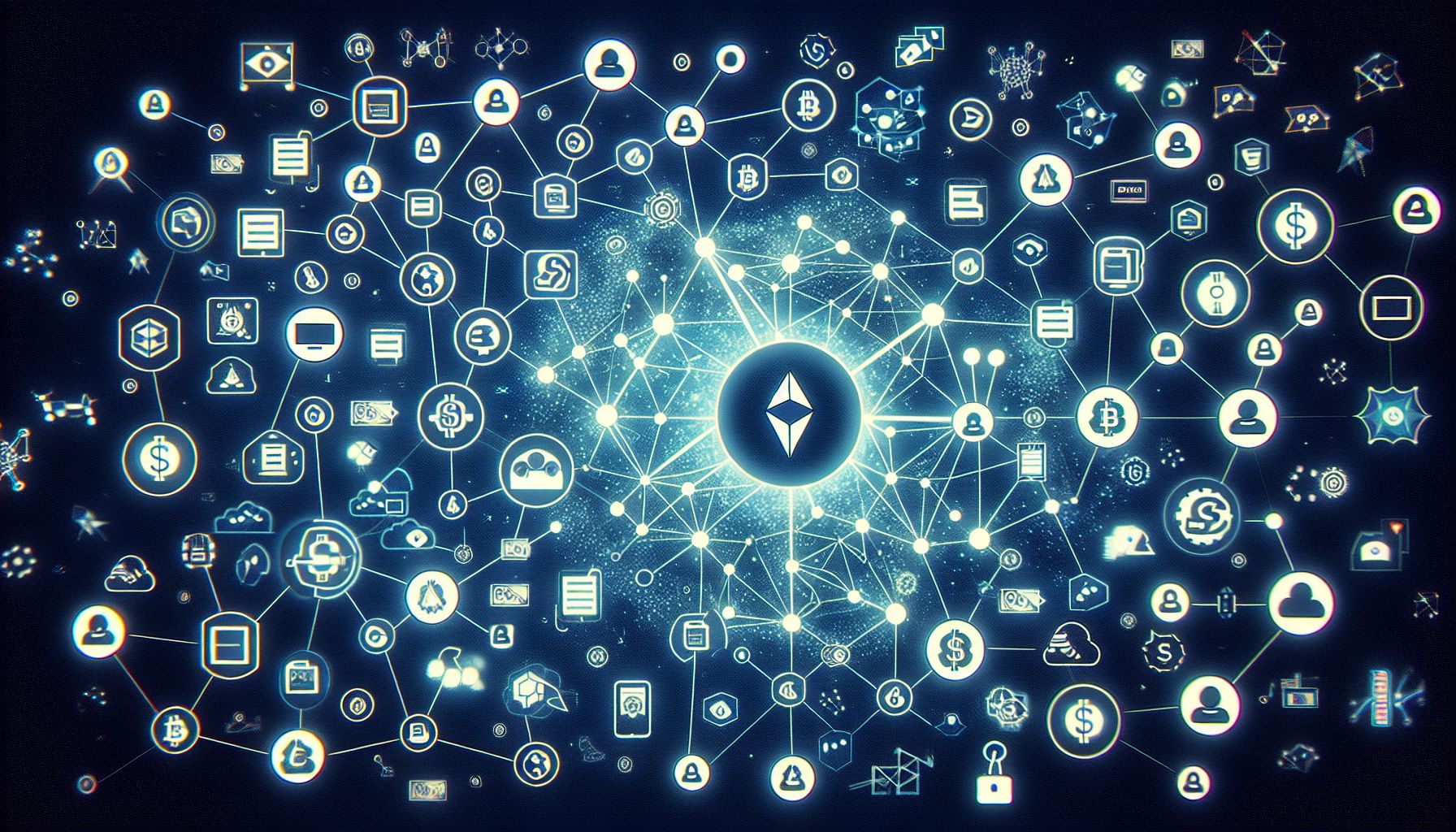

Decentralized Finance (DeFi) has been revolutionizing the world of finance by providing individuals with more control over their assets and offering a wide range of financial services without the need for traditional intermediaries. One of the prominent DeFi ecosystems that has been gaining attention in the crypto community is Aave.

Introduction to Aave

Aave is a decentralized lending platform that allows users to borrow and lend various crypto assets without the need for a centralized authority. By utilizing smart contracts on the Ethereum blockchain, Aave enables users to earn interest on their assets or borrow funds against them.

Features of Aave

One of the key features of Aave is its “flash loans” functionality, which allows users to borrow assets without the need for collateral as long as the funds are returned within the same transaction. This has opened up a wide range of possibilities for traders and developers to execute complex strategies in a seamless and efficient manner.

Moreover, Aave offers a wide range of assets that can be used for lending and borrowing, including popular cryptocurrencies such as Ethereum, Bitcoin, and stablecoins like DAI and USDC. This provides users with flexibility and diversity in their investment strategies.

Security and Transparency

Aave is known for its focus on security and transparency. The platform has undergone multiple security audits by reputable firms to ensure the safety of user funds and the integrity of the smart contracts. Additionally, Aave provides users with detailed information on the performance of their assets, interest rates, and other metrics, allowing for informed decision-making.

Conclusion

In conclusion, Aave is a prominent DeFi ecosystem that is reshaping the financial landscape by providing users with innovative lending and borrowing solutions. With its focus on security, transparency, and user-friendly features, Aave has established itself as a trusted platform in the rapidly evolving DeFi space. Whether you are a crypto enthusiast looking to earn interest on your assets or a developer seeking to leverage flash loans for sophisticated strategies, Aave offers a wide range of opportunities for users to explore and benefit from.